Working two or more jobs can boost your total income, but it also makes paycheck math more complicated. Each employer calculates taxes as if that job were your only source of income. Without adjustments, this can lead to under-withholding and a surprise tax bill later. Knowing how to estimate your combined take-home pay gives you control over your budget and tax planning.

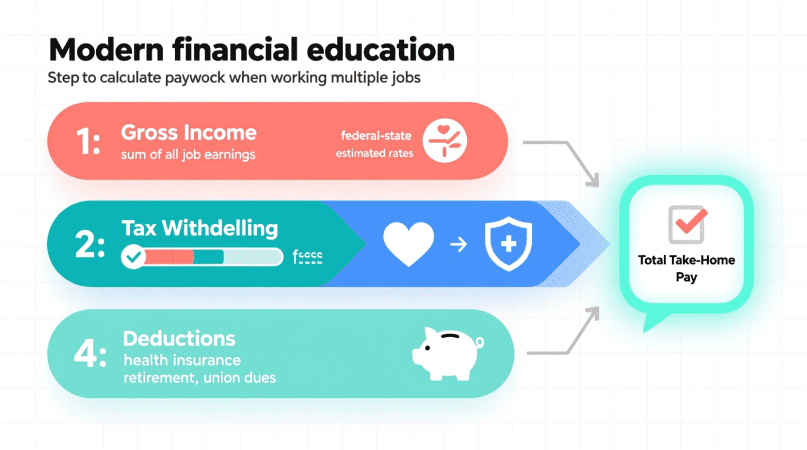

Step-by-Step: How to Calculate Net Pay Across Multiple Jobs

Step 1 — Add Up Gross Income

Start with your gross pay from each employer.

- Job A: hourly rate × hours worked (or salary ÷ pay periods).

- Job B: same calculation.

- Total gross = Job A + Job B.

👉 If you want a quick check on one of your roles, you can try a city paycheck calculator for individual income before combining both jobs.

Step 2 — Adjust Your W-4 Forms

Federal withholding is where most people run into problems with multiple jobs.

- For your main job, complete your W-4 with dependents and filing status.

- For your other job(s), use the multiple jobs checkbox (Step 2c on the W-4) or request extra withholding.

- You can also use the IRS Tax Withholding Estimator to see if you’re on track.

Step 3 — Apply Pre-Tax Deductions

Each job may offer benefits that reduce taxable wages, such as:

- 401(k) or 403(b) retirement contributions

- Health, dental, or vision insurance

- HSA or FSA contributions

⚠️ Remember: IRS limits apply to your total contributions across all employers. For example, you can’t contribute more than the 2025 maximum even if you have two retirement plans. Workers in Denver can estimate total earnings using the Colorado paycheck calculator.

Step 4 — Calculate FICA Taxes

Social Security (6.2%) and Medicare (1.45%) are withheld separately by each employer.

- Social Security applies up to the annual wage cap ($176,100 in 2025).

- Medicare applies to all wages, with an extra 0.9% if your combined income exceeds $200,000 (single) or $250,000 (married filing jointly).

Step 5 — Estimate Federal and State Taxes

- Combine your taxable wages from all jobs.

- Subtract the standard deduction ($15,000 single / $30,000 married in 2025).

- Apply IRS tax brackets to your total income.

- Compare with the actual withholding from each employer to see if you’re over- or under-withheld.

👉 For updated tax bracket details, see the federal withholding updates for 2025.

Step 6 — Subtract Post-Tax Deductions

After taxes, each employer may still withhold:

- Roth 401(k) contributions

- Union dues

- Wage garnishments

- Charitable deductions

Worked Example

- Job A: $400 gross – $30 FICA – $40 federal – $20 state = $310 net

- Job B: $375 gross – $28 FICA – $35 federal – $15 state = $297 net

- Total net paycheck = $607

If withholding is too low, you may need to request extra withholding at one job to avoid a tax bill later.

FAQs

Will I pay more tax if I work two jobs?

Not more than someone with the same total income, but your combined wages may push you into a higher bracket.

Why are my paychecks under-withheld?

Each employer assumes you only work for them. You must adjust your W-4 to reflect multiple jobs.

Can I get benefits from both jobs?

Yes, but contribution limits apply across employers.

Do I pay Social Security twice?

Yes, but if you exceed the annual cap you can claim a refund when you file your taxes.

What’s the easiest way to estimate my net pay?

Add gross pay from all jobs, then apply deductions and taxes. For Baltimore residents, calculate your income accurately with our Maryland paycheck calculator.

Bettye is the creator of CityPaycheckCalculator.com, a resource designed to help individuals quickly and accurately estimate their take-home pay across U.S. cities. With a strong focus on clarity, accuracy, and user experience, Bettye provides reliable paycheck calculators and helpful insights to support smarter financial decisions. Her mission is to make complex payroll and tax information simple and accessible for everyone.