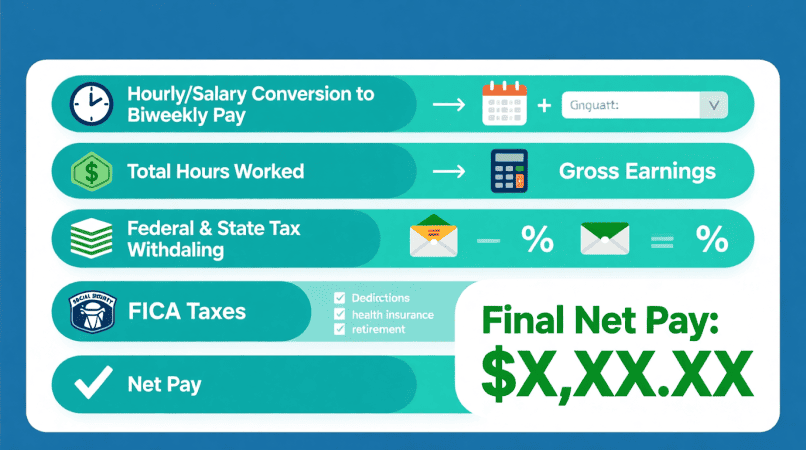

If you’re paid every two weeks, you probably ask yourself: “How much will I really take home after taxes and deductions?” Your gross salary is only the starting point. What truly matters is your net biweekly paycheck, the amount that shows up in your bank account. Let’s walk through the steps and give you examples so you can calculate it yourself.

What Does “Biweekly” Mean for Your Paycheck?

Biweekly pay means you’ll get 26 paychecks each year. That’s two more than semi-monthly pay schedules (24). While your annual salary doesn’t change, each paycheck will be distributed differently, which affects how federal and state withholding is calculated. Residents of Denver can check the Colorado salary calculator for 2025 tax rules.

Step 1: Find Your Gross Biweekly Pay

Your gross pay is your total income before any deductions.

- Salaried employees: divide your yearly salary by 26.

- Hourly employees: multiply your hourly rate by total hours worked in two weeks.

Example: $65,000 ÷ 26 = $2,500 gross every two weeks.

Step 2: Subtract Federal Income Taxes

Your employer uses IRS withholding tables to calculate your federal tax withholding, based on your W-4, filing status, and dependents. This ensures you’re paying into your annual tax obligation evenly across the year. To budget properly, use our salary after tax calculator and avoid surprises on your paycheck.

Step 3: Subtract FICA Contributions

Every paycheck also includes:

- Social Security tax: 6.2% of wages (up to the yearly cap)

- Medicare tax: 1.45% of wages (plus 0.9% if you earn over $200,000)

On a $2,500 gross paycheck, FICA takes about $191. For Indianapolis professionals, see the Indiana paycheck calculator for net income details.

Step 4: Factor in State and Local Taxes

Where you live makes a huge difference. For example:

- In Florida, there’s no state income tax.

- In New York, state and sometimes city taxes can be significant.

You can test it yourself:

- Try the Philadelphia paycheck calculator to see how city income tax changes your net pay.

- Use the Houston paycheck calculator if you want to see results in a no-income-tax state.

Step 5: Deduct Insurance and Retirement Contributions

Most workers have some pre-tax deductions, which lower taxable income:

- Health, dental, or vision insurance

- 401(k) or retirement contributions

- HSA or FSA contributions

Other deductions, like life insurance or union dues, may be post-tax and reduce your net take-home directly.

Step 6: Arrive at Your Net Biweekly Pay

After subtracting federal, FICA, state, and personal deductions, what’s left is your net paycheck.

Quick Example:

- Gross pay: $2,500

- Federal tax: $275

- FICA: $191

- State tax: $130

- Insurance + 401(k): $200

- Net pay = $1,704

Compare with the Boston paycheck calculator to understand how Massachusetts taxes affect your take-home pay.

FAQs About Biweekly Paychecks

How do I figure out my take-home pay manually?

Start with gross pay, subtract federal income tax, Social Security, Medicare, state/local tax, and deductions.

Does biweekly mean I get more money?

No—your annual salary stays the same, but your pay is split into 26 checks instead of 24 or 12.

How do pre-tax deductions help?

They reduce taxable income, which lowers the federal and state taxes withheld.

Can overtime change my biweekly pay?

Yes, hourly workers with overtime will see a bigger gross paycheck, but deductions still apply.

longer, authority-style post (~2,000 words) where I rotate through 6–8 different city/state internal links spread naturally in examples and comparison tables?

Bettye is the creator of CityPaycheckCalculator.com, a resource designed to help individuals quickly and accurately estimate their take-home pay across U.S. cities. With a strong focus on clarity, accuracy, and user experience, Bettye provides reliable paycheck calculators and helpful insights to support smarter financial decisions. Her mission is to make complex payroll and tax information simple and accessible for everyone.