Part-time jobs can be unpredictable—your hours may change each week, and your benefits and deductions may look different from full-time employees. Still, there’s a simple way to estimate your paycheck if you work part-time, so you can plan your budget and know what to expect on payday.

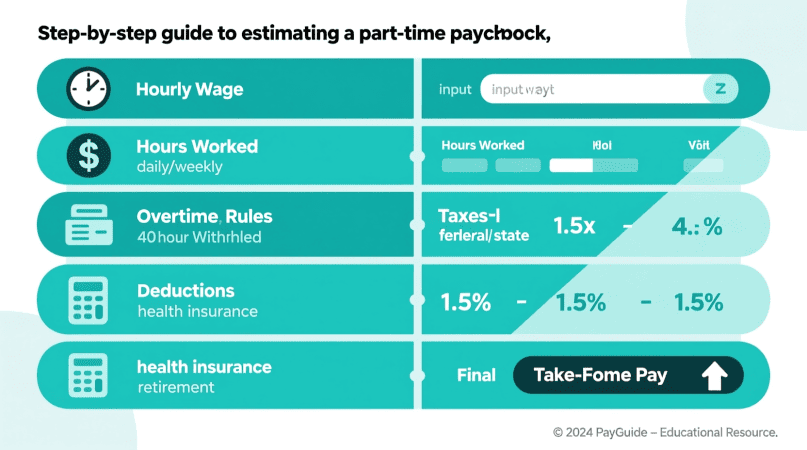

Step 1: Start With Gross Pay

Your gross pay is what you earn before taxes and deductions.

Formula: Hourly rate × Hours worked = Gross pay

Example:

If you make $18/hour and work 20 hours in a week:

$18 × 20 = $360 gross pay

If your schedule varies, use an average of your weekly hours (e.g., 22–25 hours).

Step 2: Estimate Federal Income Tax

Your employer withholds federal taxes each paycheck. The amount depends on your:

- W-4 form (filing status, dependents, additional withholding)

- Total annual income projection

- IRS tax brackets for the year

Since many part-time workers earn less annually, effective federal tax rates are often lower. The paycheck estimator tool helps employees and freelancers alike determine what they’ll actually earn per pay period.

Step 3: Subtract FICA Taxes

Every employee pays payroll taxes:

- Social Security tax: 6.2% of gross pay (up to annual limit)

- Medicare tax: 1.45% of gross pay (no limit)

On a $360 paycheck, FICA totals about $27.

Step 4: Account for State and Local Taxes

Taxes vary widely depending on where you live:

- States like Texas or Florida do not withhold income tax.

- States like California or New York may take a noticeable portion.

- Some cities (e.g., Philadelphia) also add local income tax.

👉 New York employees should try the New York state calculator for an accurate state withholding view.

Step 5: Subtract Benefits or Other Deductions

Part-time employees may or may not receive benefits, but if you do, deductions could include:

- Pre-tax: health insurance, commuter benefits, retirement savings (lowers taxable income).

- Post-tax: union dues, disability insurance, garnishments.

Step 6: Arrive at Net (Take-Home) Pay

Example for a part-time worker ($18/hr, 20 hours per week in California):

- Gross pay: $360

- Federal tax: $30

- FICA: $27

- State tax: $15

- No deductions

Net weekly paycheck ≈ $288

Multiply by 4 for a monthly estimate: $1,152 net pay.

Quick Comparison: 15, 20, 30 Hours/Week at $18/hr

| Hours Worked | Gross Pay | Estimated Net (CA) | Estimated Net (TX) |

|---|---|---|---|

| 15 hrs | $270 | ~$218 | ~$230 |

| 20 hrs | $360 | ~$288 | ~$306 |

| 30 hrs | $540 | ~$432 | ~$459 |

👉 Compare different regions with our Chicago city calculator.

Why Estimating Your Part-Time Paycheck Matters

- Helps with weekly budgeting (groceries, transportation).

- Lets you decide whether you need additional hours or another job.

- Shows how taxes and benefits impact smaller paychecks.

- Prepares you for income swings if your hours change often.

FAQs

Do part-time workers pay the same taxes as full-time?

Yes. The same tax rules apply, but with a lower annual income, your effective tax rate is usually smaller.

How do I estimate my paycheck if my hours vary?

Use your average weekly hours over a month, then calculate gross and subtract about 20–25% for taxes.

Can part-time workers claim dependents on their W-4?

Yes, which can lower federal withholding and increase take-home pay.

Do benefits reduce part-time paychecks?

Yes, especially if health insurance or retirement contributions are deducted pre-tax.

How can I quickly estimate without doing the math?

Multiply your hours by your hourly rate, then subtract around 20% for taxes in no-tax states, or 25–30% in high-tax states.

Bettye is the creator of CityPaycheckCalculator.com, a resource designed to help individuals quickly and accurately estimate their take-home pay across U.S. cities. With a strong focus on clarity, accuracy, and user experience, Bettye provides reliable paycheck calculators and helpful insights to support smarter financial decisions. Her mission is to make complex payroll and tax information simple and accessible for everyone.