Seasonal and freelance work gives you flexibility and often quick income, but it also comes with a big question: how much of that money do you actually keep after taxes? Unlike regular employees, you may not have taxes withheld automatically. That means you need to estimate your net pay yourself.

This guide breaks it down step by step with clear examples. Workers in Chicago can check the Illinois paycheck calculator for full statewide tax details.

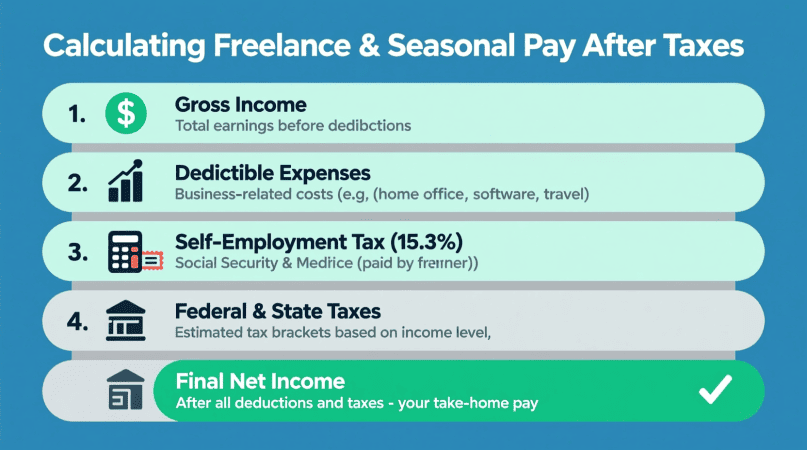

Step 1: Add Up Your Gross Income

- Seasonal job (W-2): Multiply your hourly rate by the number of hours you’ll work.

- Freelance (1099): Add up your expected contracts or invoices.

Example:

- Summer retail at $18/hour × 25 hours/week × 12 weeks = $5,400 gross income

- Freelance design project = 3 contracts × $1,500 each = $4,500 gross income

Step 2: Subtract Business Expenses (Freelancers Only)

Freelancers can deduct costs directly tied to work:

- Home office or coworking fees

- Internet, phone, and software

- Supplies or equipment

- Mileage or travel

If your $4,500 freelance earnings came with $800 in expenses, your taxable income = $3,700.

Step 3: Calculate Federal Taxes

Both seasonal and freelance income is subject to federal income tax. Use IRS tax brackets to estimate based on your total yearly income.

- Seasonal workers (W-2): Employers usually withhold federal tax, but it may not cover everything.

- Freelancers (1099): You must set aside tax yourself—plan on about 10–22% depending on income level.

Step 4: Add Self-Employment Tax (Freelancers Only)

Freelancers pay both the employer and employee share of Social Security and Medicare:

- 12.4% Social Security

- 2.9% Medicare

= 15.3% self-employment tax

On $3,700 taxable freelance income, SE tax is about $566.

Step 5: Estimate State and Local Taxes

Taxes vary widely:

- Texas, Florida, Nevada: No state income tax.

- California, New York: 5–10% state tax.

- Some cities, like Philadelphia, add local tax.

👉 Try the California paycheck calculator or Texas paycheck calculator for exact numbers.

Step 6: Calculate Your Net Pay

Example 1: Freelancer ($4,500 income, $800 expenses, CA resident)

- Net income after expenses: $3,700

- Federal tax (12%): $444

- Self-employment tax (15.3%): $566

- State tax (5%): $185

- Net pay = $2,505

Example 2: Seasonal worker ($5,000 gross in TX, no benefits)

- Federal tax (10%): $500

- FICA (7.65%): $383

- State tax: $0

- Net pay = $4,117

For accurate state-by-state estimates, try our free city and state paycheck calculators to see what your real take-home pay will be.

Quick Comparison Table

| Worker Type | Gross Pay | Federal Tax | Other Taxes | Net Pay |

|---|---|---|---|---|

| Freelancer | $4,500 | $444 | $751 (SE + state) | $2,505 |

| Seasonal (TX) | $5,000 | $500 | $383 (FICA) | $4,117 |

| Seasonal (CA) | $5,000 | $500 | $650 (FICA + state) | $3,850 |

If you’re from Miami, see the Florida state calculator to estimate tax deductions. Before negotiating a job offer, calculate your take-home pay to understand your actual earnings after all deductions.

FAQs

Do freelancers pay more tax than seasonal workers?

Yes. Freelancers owe self-employment tax (15.3%) in addition to income tax, while seasonal workers split payroll tax with their employer.

How much should I set aside for freelance taxes?

A safe rule is 25–30% of your income, covering federal, SE, and state taxes.

Do seasonal workers always have taxes withheld?

Employers withhold, but it may be too little if you work multiple jobs. You may owe at tax time.

Can freelancers deduct expenses?

Yes—deductions like home office, mileage, or software reduce taxable income.

Do I need to pay taxes quarterly as a freelancer?

Yes, if you expect to owe more than $1,000 in federal taxes. Use IRS Form 1040-ES.

eelance pay after taxes. Step-by-step guide with examples, tables, and free state paycheck calculators for accurate take-home pay.”

Would you like me to expand this into a longer authority post (2,000+ words) with separate deep-dive sections for seasonal (W-2) vs freelance (1099), including multi-state comparisons (California, Texas, Florida, New York) to maximize internal linking?

Bettye is the creator of CityPaycheckCalculator.com, a resource designed to help individuals quickly and accurately estimate their take-home pay across U.S. cities. With a strong focus on clarity, accuracy, and user experience, Bettye provides reliable paycheck calculators and helpful insights to support smarter financial decisions. Her mission is to make complex payroll and tax information simple and accessible for everyone.