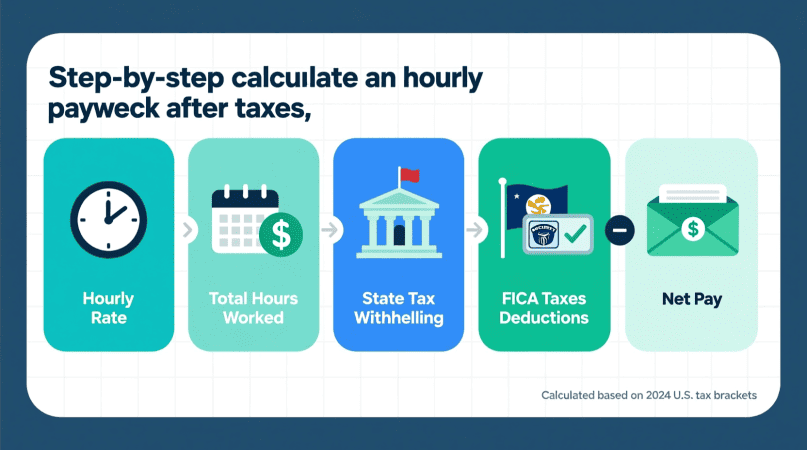

If you’re paid by the hour, your paycheck can look different every pay period. The number of hours you work, your tax situation, and your deductions all affect how much money actually shows up in your bank account. Knowing how to calculate your hourly paycheck after taxes helps you plan your budget and avoid surprises on payday.

Step 1: Start With Gross Hourly Pay

Your gross pay is the total before taxes and deductions.

- Formula:

Hourly rate × Hours worked - Example: If you earn $20/hour and work 40 hours a week, your gross weekly pay is:

$20 × 40 = $800

If you worked 5 hours of overtime at time-and-a-half ($30/hour), add $150, bringing gross pay to $950.

Try our free hourly paycheck calculators by state to see your exact net pay based on where you live and how many hours you work.

Step 2: Subtract Federal Income Tax

Federal withholding depends on:

- Your W-4 form (filing status and dependents)

- Your total annual income

- IRS withholding tables

This isn’t a flat percentage—it’s progressive, meaning higher income portions are taxed at higher rates.

Step 3: Subtract FICA Taxes

These are mandatory payroll taxes:

- Social Security tax: 6.2% of wages (up to the yearly cap)

- Medicare tax: 1.45% of wages (plus an extra 0.9% if you earn over $200,000 annually)

On an $800 paycheck, FICA comes to about $61.

Step 4: Subtract State and Local Taxes

Your take-home pay changes depending on where you live.

- States like Texas or Florida have no income tax.

- States like California or New York withhold a larger share.

- Some cities, like Philadelphia, also add local tax.

👉 To understand statewide rates beyond Seattle, visit the Washington state calculator.

Step 5: Subtract Benefits and Contributions

Many deductions reduce your taxable income:

- Pre-tax deductions: 401(k) retirement contributions, health insurance, HSA or FSA plans.

- Post-tax deductions: union dues, disability insurance, or wage garnishments.

These can change your net pay significantly depending on your benefits package.

Step 6: Find Your Net Hourly Pay

After subtracting taxes and deductions, what’s left is your take-home pay.

Example:

- Gross weekly pay: $800

- Federal income tax: $80

- FICA: $61

- State tax (CA): $30

- Health insurance: $50

Net weekly paycheck = $579

If you divide $579 by 40 hours, your net hourly pay is about $14.47/hour, even though your gross rate is $20/hour.

Why This Matters

- Helps you budget realistically using take-home pay, not gross pay.

- Shows how overtime, benefits, or state taxes affect your bottom line.

- Lets you compare jobs or offers based on actual paycheck amounts, not just hourly rates.

FAQs

How do I calculate my net hourly pay without a calculator?

Multiply your hours by your rate, then subtract about 20–30% for taxes and deductions.

Does hourly vs salary change how taxes are withheld?

No. The same tax rules apply; the difference is how your income is measured.

Do overtime hours increase my tax rate?

They increase your gross pay and withholding, but your actual yearly tax rate only changes if you move into a higher bracket.

Which states don’t take income tax out of hourly paychecks?

Texas, Florida, Nevada, Washington, Alaska, Wyoming, South Dakota, and Tennessee (on wages).

Why is my net hourly rate lower than my gross?

Because federal, FICA, state taxes, and benefits reduce the amount you actually take home.

Bettye is the creator of CityPaycheckCalculator.com, a resource designed to help individuals quickly and accurately estimate their take-home pay across U.S. cities. With a strong focus on clarity, accuracy, and user experience, Bettye provides reliable paycheck calculators and helpful insights to support smarter financial decisions. Her mission is to make complex payroll and tax information simple and accessible for everyone.