When you’re trying to budget or compare job offers, one detail often gets overlooked: pay frequency. Two employees with the same salary may take home different amounts per paycheck simply because one is paid weekly and the other biweekly. The math isn’t complicated, but the differences matter for taxes, deductions, and personal budgeting.

Weekly vs Biweekly: What Do They Mean?

- Weekly pay: You’re paid once every week, usually 52 times a year.

- Biweekly pay: You’re paid every two weeks, which means 26 paychecks per year.

At first glance, it looks like weekly pay gives you “more money.” In reality, your annual salary stays the same—it’s just split into more checks.

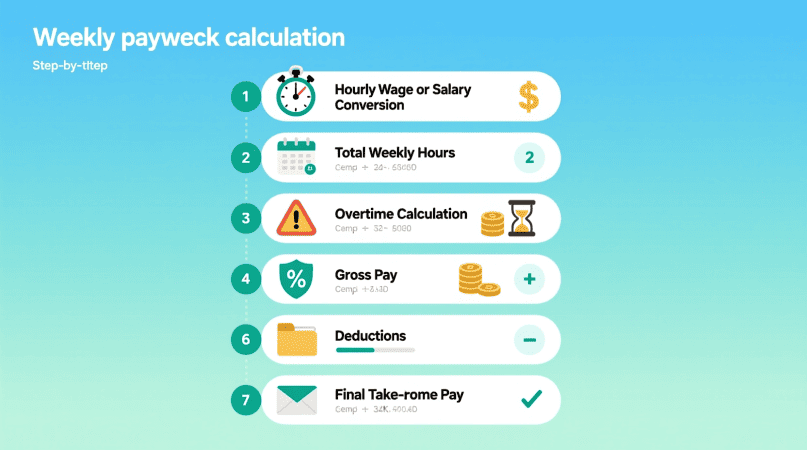

Step 1: Calculate Gross Pay for Each Frequency

Formula for weekly gross pay:Annual Salary ÷ 52

Formula for biweekly gross pay:Annual Salary ÷ 26

Example: If you earn $52,000 annually:

- Weekly gross = $52,000 ÷ 52 = $1,000

- Biweekly gross = $52,000 ÷ 26 = $2,000

Step 2: Factor in Taxes and Deductions

Taxes are withheld based on your pay frequency. Smaller checks mean smaller deductions each week; larger checks mean larger deductions every two weeks. Either way, your yearly tax bill doesn’t change.

Common deductions include:

- Federal income tax (based on your W-4)

- FICA taxes: 6.2% Social Security + 1.45% Medicare

- State and local taxes (varies widely)

- Pre-tax contributions like 401(k) or health insurance

👉 Want to see the real difference? If you’re in Boston, compare your salary using the Massachusetts paycheck calculator.

Step 3: Compare Weekly vs Biweekly Take-Home Pay

Here’s a simple comparison for someone earning $52,000 with standard deductions:

| Pay Frequency | Gross per Period | Typical Deductions | Estimated Net Pay | Paychecks per Year |

|---|---|---|---|---|

| Weekly | $1,000 | ~$220 | ~$780 | 52 |

| Biweekly | $2,000 | ~$440 | ~$1,560 | 26 |

Notice that deductions scale up or down with the size of your paycheck. The annual total is identical, but the timing of your cash flow changes. Want a more accurate salary breakdown? This tool lets you factor in tax brackets, benefits, and withholdings easily.

Step 4: Extra Paychecks and Budgeting

With weekly pay, your income is more frequent but smaller. With biweekly pay, most months you’ll see two paychecks—but two months each year will give you three paychecks. This can feel like a bonus and is often used for savings or big expenses.

Tip: Mark those extra paycheck months on your calendar. Planning ahead makes it easier to use that income wisely.

Step 5: Real-Life Scenarios

- Hourly worker with overtime: Weekly schedules make it easier to track overtime since it resets every seven days.

- Salaried employee with 401(k): Biweekly pay means retirement contributions are pulled less often but in larger amounts.

- Different states: Compare with the Boston paycheck calculator for higher state taxes, or the Miami paycheck calculator to see results in a no-income-tax state.

Workers in Phoenix can use the Arizona state calculator for updated figures.

FAQs

Do you make more money on weekly vs biweekly pay?

No. The total annual salary is the same—it’s just split into more or fewer checks.

Does pay frequency change how much tax I owe?

No. Your tax liability is based on yearly income, but withholding is calculated per pay period.

Why do some months have 3 paychecks in biweekly schedules?

Because 26 pay periods don’t divide evenly into 12 months. Two months each year will have 3 paydays.

Which is better for budgeting?

Weekly works well for short-term cash flow. Biweekly works better if you align it with bills like rent or mortgage.

Bettye is the creator of CityPaycheckCalculator.com, a resource designed to help individuals quickly and accurately estimate their take-home pay across U.S. cities. With a strong focus on clarity, accuracy, and user experience, Bettye provides reliable paycheck calculators and helpful insights to support smarter financial decisions. Her mission is to make complex payroll and tax information simple and accessible for everyone.