If you’ve ever looked at your paycheck and wondered why the tax withholding feels off, the answer often comes down to your Form W-4. Filling out this form correctly helps your employer withhold the right amount of federal income tax—so you don’t get stuck with a surprise bill at tax time or lose too much money up front.

This guide walks you through how to fill out your W-4 in 2025 for accurate paycheck withholding, with step-by-step instructions and examples.

What Is a W-4 Form?

Form W-4, officially called the Employee’s Withholding Certificate, tells your employer how much federal income tax to withhold from each paycheck. Unlike in the past, the IRS no longer uses “allowances.”

The updated form (since 2020) focuses on filing status, dependents, multiple jobs, and adjustments. Use the Texas state calculator to compare your Houston salary with the rest of the state.

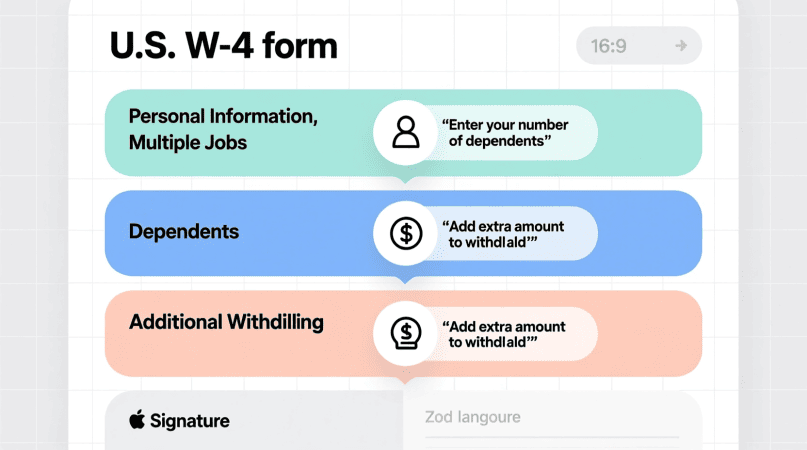

Step-by-Step Guide to Filling Out W-4

Step 1: Enter Personal Information

Provide your name, address, Social Security number, and filing status (Single, Married Filing Jointly, or Head of Household). Filing status directly affects withholding rates.

Step 2: Multiple Jobs or Working Spouse

- If you have more than one job—or your spouse works—check the box in Step 2(c).

- For greater accuracy, use the IRS Tax Withholding Estimator or complete the Multiple Jobs Worksheet included with the form.

- This step helps prevent under-withholding, which is common in two-income households.

Step 3: Claim Dependents

If your income is under $200,000 (or $400,000 if married filing jointly), you can reduce withholding by claiming dependents:

- $2,000 for each qualifying child under 17

- $500 for other dependents

This lowers the amount withheld each pay period and increases take-home pay.

Step 4: Other Adjustments

This optional step fine-tunes your withholding.

- 4(a): Other Income – report interest, dividends, freelance income.

- 4(b): Deductions – if you plan to itemize deductions greater than the standard deduction.

- 4(c): Extra Withholding – enter an additional dollar amount you want withheld per paycheck. This is useful if you expect extra taxable income, like side gigs or capital gains.

👉 Curious what your paycheck looks like with these adjustments? Try the Chicago paycheck calculator for a quick example based on your location.

Step 5: Sign and Date

Your W-4 isn’t valid until it’s signed and dated. Submit it to your employer, not the IRS.

When to Update Your W-4

You should update your W-4 whenever your financial or personal situation changes:

- Marriage or divorce

- New child or dependent

- Starting or ending a second job

- Major income shifts (freelance, investments)

For example, if you live in Texas and just picked up extra hours, the Texas hourly paycheck calculator can help you see how your withholding might affect your net pay. Use the City Paycheck Calculator to instantly calculate your take-home salary after federal, state, and local deductions.

Real-Life Examples

- Single worker, one job, no dependents: Just fill Steps 1 and 5. Straightforward withholding.

- Married couple with two kids, both working: Use Step 2 to account for both incomes, Step 3 to claim dependents, and consider Step 4(c) for extra withholding if one spouse has side income.

- Freelancer + W-2 job combo: Fill Steps 1 and 5, but use Step 4(a) to add estimated freelance income so taxes don’t come due all at once.

👉 If you’re in California, you can test scenarios with the state paycheck calculator to compare how withholding changes your take-home pay.

Bettye is the creator of CityPaycheckCalculator.com, a resource designed to help individuals quickly and accurately estimate their take-home pay across U.S. cities. With a strong focus on clarity, accuracy, and user experience, Bettye provides reliable paycheck calculators and helpful insights to support smarter financial decisions. Her mission is to make complex payroll and tax information simple and accessible for everyone.